Many compounding factors over the last few years have resulted in a weak economy and high interest rates. While this has had its impact on the residential property market with overall sales volumes lower now than pre-Covid, it is encouraging to see how the relative proportion of sales in some areas (provinces/municipalities/towns) is getting an even larger proportion of the sales than pre-2019.

The Western Cape has significantly grown its share of residential sales activity since Covid while South Africa’s economic engine room, Gauteng, has been the biggest loser. And across the country, it is smaller towns which have benefited rather than the large metros.

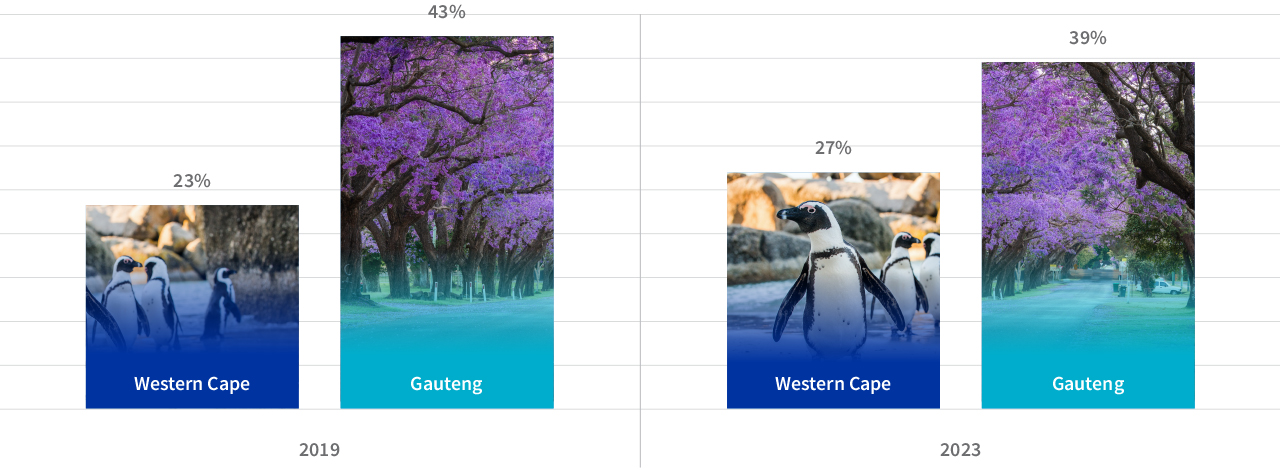

Lightstone’s assessment of the proportion of sales between R100k and R20m in 2019 and 2023 shows that the Western Cape’s share has jumped from 23% to 27%, while Gauteng has slipped from 43% to 39%.

Gauteng and Western Cape: proportion of all sales

Although the bigger proportion of sales are in Gauteng the difference between Gauteng and the Western Cape has shrunk from 20% (45%-23%) to 12% (39% -27%).

The most active municipalities in the Western Cape are Overstrand, Stellenbosch and Hessequa, followed by Knysna, Prince Albert, Saldanha Bay, Kannaland, Swellendam, Bergrivier and Cape Agulhas. Cape Town also increased its share of activity from 15% to 17%, while just four municipalities in the province did not perform positively – Breede Valley, Cederberg, Witzenberg and Beaufort West.

In Gauteng, the City of Tshwane was relatively stable over the four years, but the City of Johannesburg dropped from 16% to 15%. Ekurhuleni and Emfuleni also lost ground, but it was the smaller municipalities that experienced the sharpest falls.

KwaZulu-Natal fell from 12% to 11% overall, and within the province eThekweni and Msunduzi were the biggest losers while Umngeni, KwaDukuza and south coast municipalities picked up in relative activity.

The Eastern Cape was marginally more active in 2023 than 2019, with Nelson Mandela Bay showing a slight improvement while Buffalo City declined. Smaller towns showing positive results included Jeffreys Bay, St Francis, Port Alfred, Kenton-on-Sea and Mthatha.

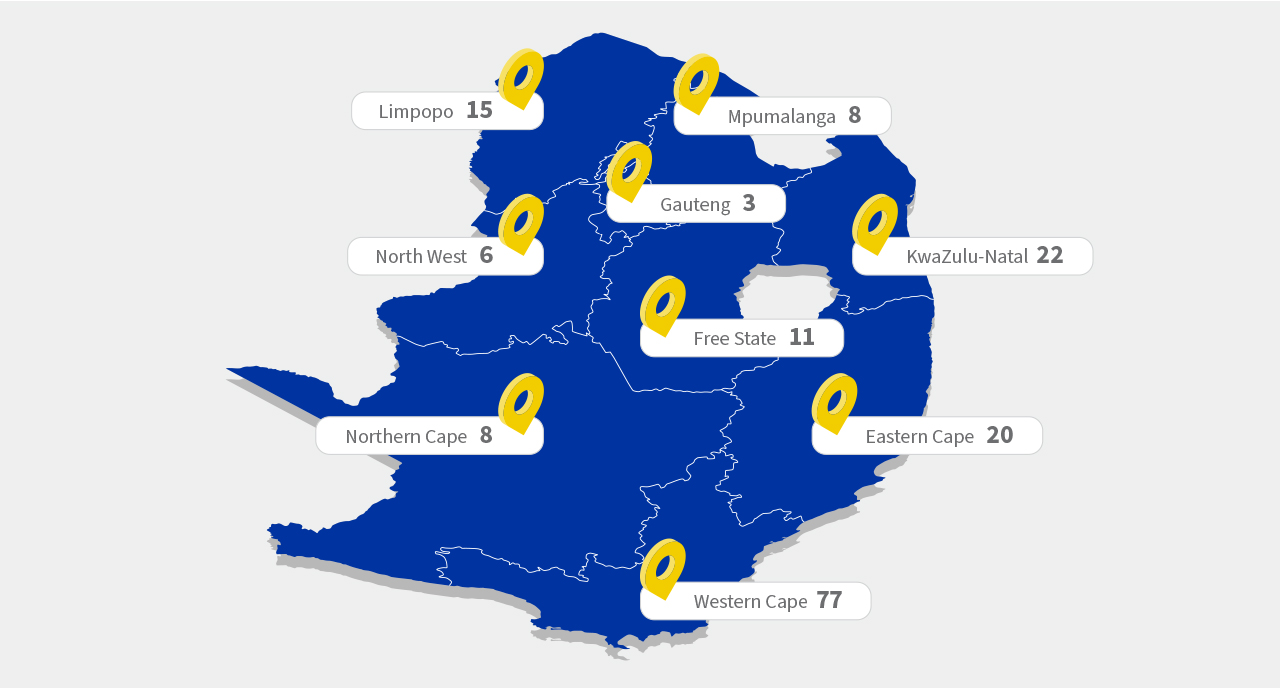

In all, there was a relative increase in sales activity in 170 towns across the country, with 77 (45%) in the Western Cape, 22 (13%) in KwaZulu-Natal and 20 (12%) in the Eastern Cape. Gauteng was last in the provincial table with just 3 (2%) of towns showing a relative increase in activity.

Number of towns per province showing an increase in relative residential sales activity

The most increased town activity (as opposed to municipality) has been around Stellenbosch, and then along the West Coast (Langebaan, Yzerfontein and St Helena Bay), inland around Darling, Riebeeck Kasteel and Barrydale, in Cape Town (Scarborough, Hout Bay, Noordhoek) and then heading east along the south coast, in towns such as Gansbaai, Stillbaai, Mossel Bay and Knysna.

In the Eastern Cape, it’s the coastal towns which have recorded higher sales activity. They include Jeffreys Bay, Kenton-on-Sea, Port Alfred, St Francis Bay, Cape St Francis and Cintsa.

In KwaZulu-Natal, towns included Ballito on the northern coast, various southern coastal towns, Howick and smaller towns in the Midlands. Parys made the cut in Free State, Dullstroom and Hazyview in Mpumalanga, and Cullinan in Gauteng.

Towns showing growth in activity