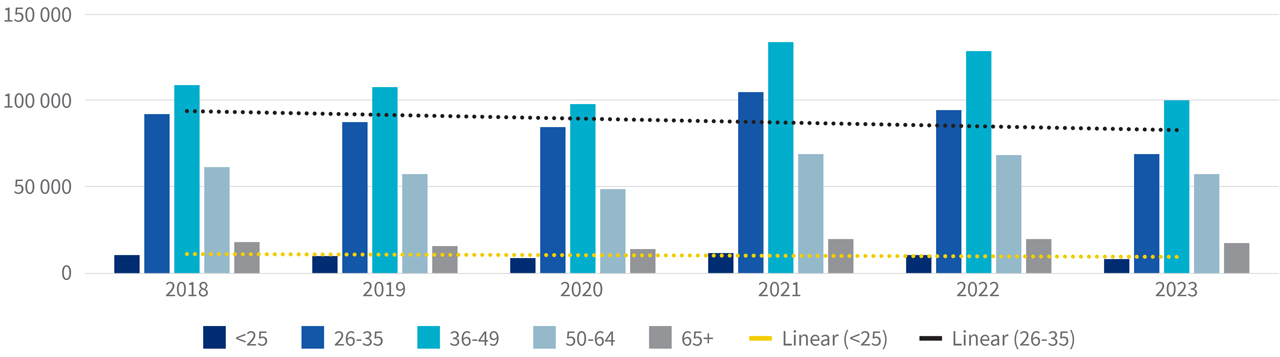

A look at Lightstone data reveals a nuanced story about the buying habits of South Africans, under the age of 35 years old, who are buying fewer but more expensive houses. Data shows that the decline in volumes is proportionately sharper than the overall fall in property purchases over the last six years. For example:

- Purchases by those between 26-35 fell 25% from 92,558 in 2018 to 69,577 in 2023, while total overall transfers registered fell 13% from 294,859 in 2018 to 255,726 in 2023.

- Buyers in the 26-35 age group accounted for 31% of total purchases in 2018, and this fell to 27% in 2023.

- Buying patterns among those under 25 have fallen proportionately to overall purchases, dropping from 11,480 purchases in 2018 to 8,977 in 2023.

Volume of people purchasing property

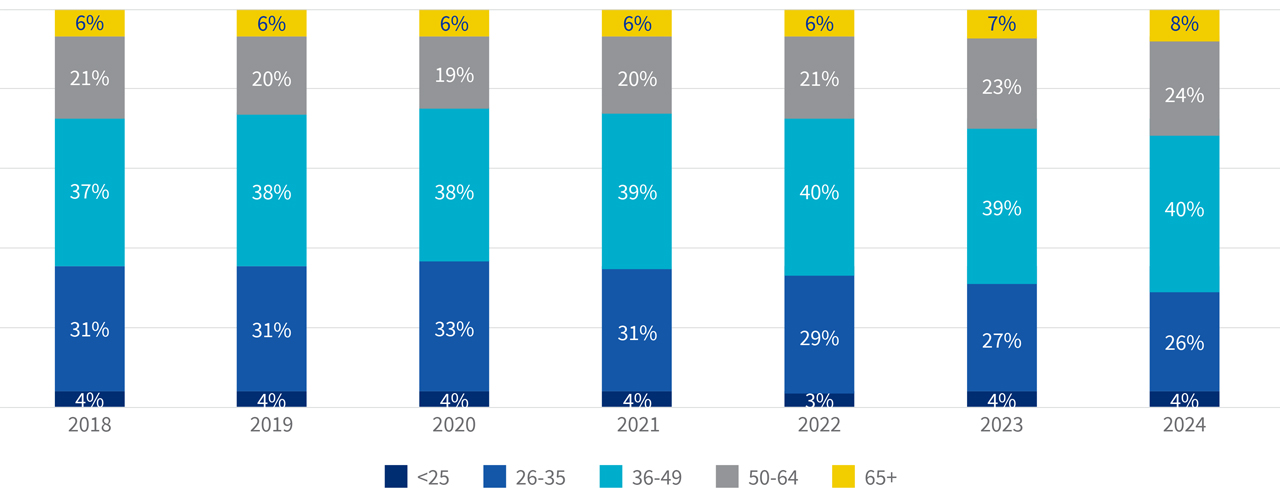

Proportion of age band split

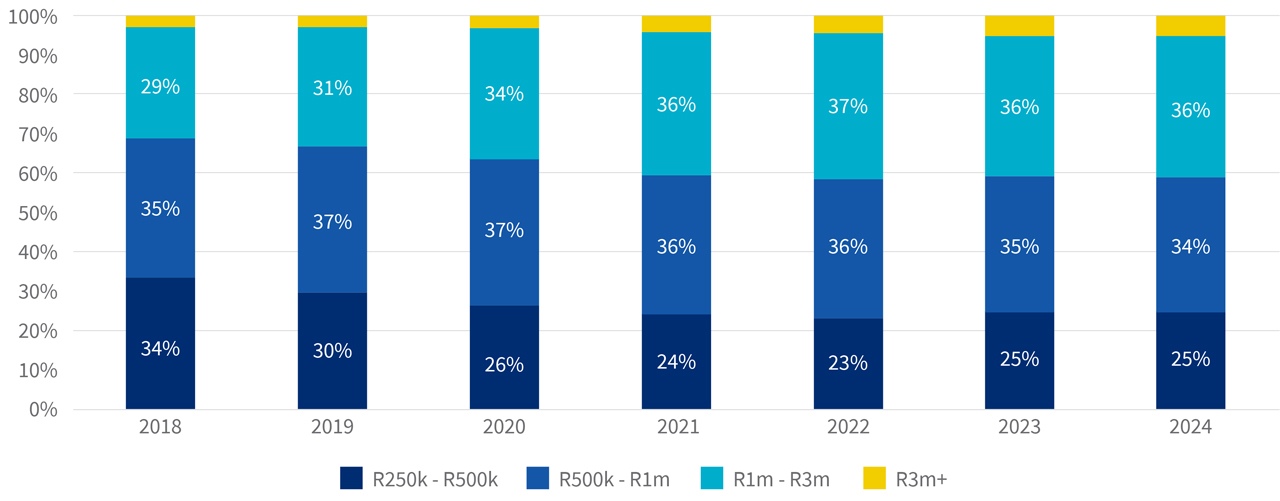

A deeper look into Lightstone’s data shows that buyers under the age of 35 are increasingly paying more for their homes. In 2023, 36% paid between R1m-R3m, compared to just 29% in 2018. Conversely, houses priced between R250k-R500k fell from 34% in 2018 to 25% in 2023.

Volume of properties purchased by buyers aged 35 and younger by value band

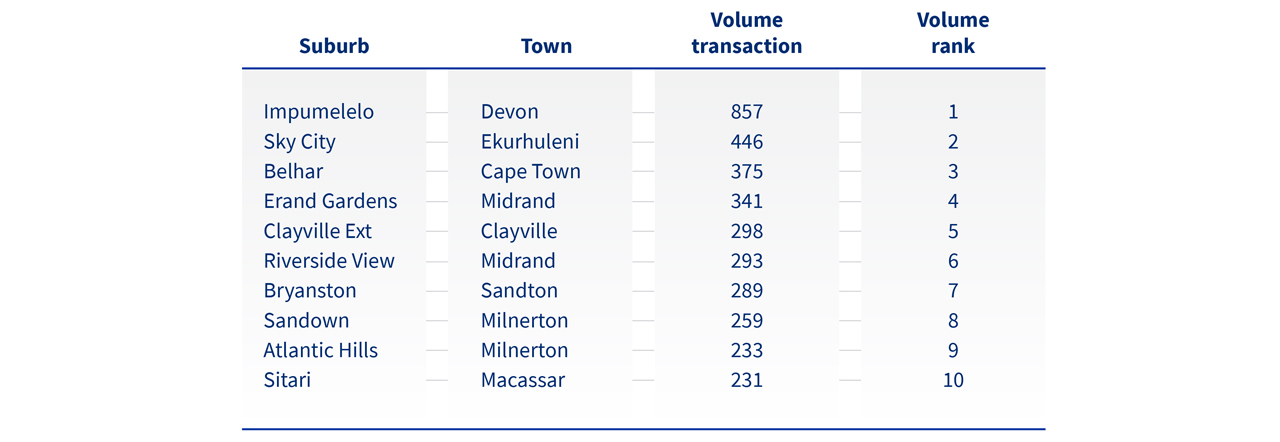

Most sales in 2023 and 2024 took place in Impumelelo, a housing development project in Devon in the Sedibeng Municipality of Gauteng), followed by Sky City (a housing development project in Ekurhuleni) and Belhar, Cape Town.

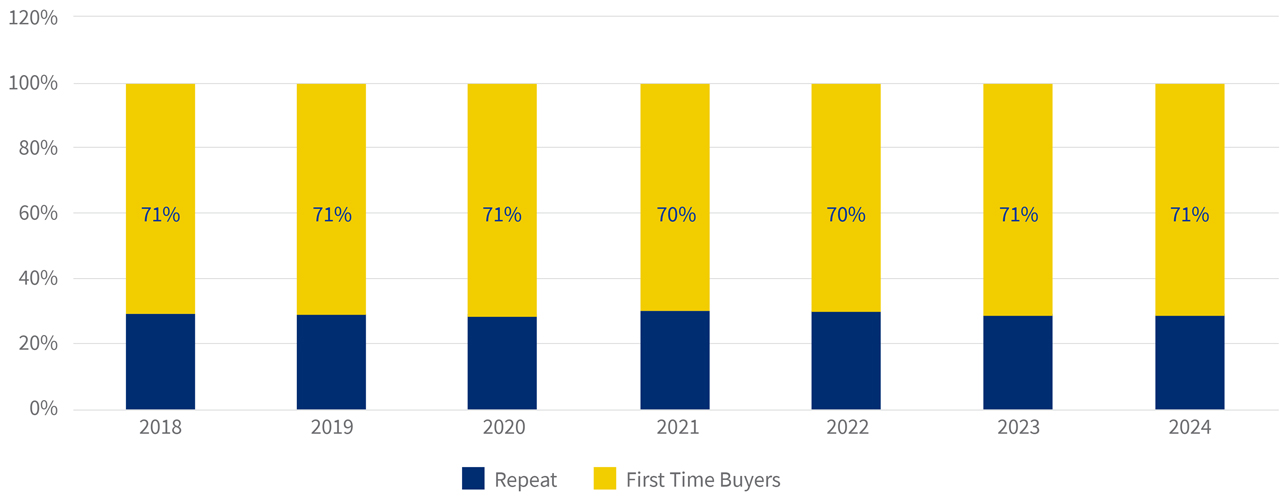

Most buyers under 35 are new entrants in the property market, with First Time Buyers accounting for 70%-71% of the market.

% of buyers aged 35 and younger who are First Time Buyers

An equally interesting story unfolds when we look to Lightstone data to understand the vehicle buying patterns of under 35s.

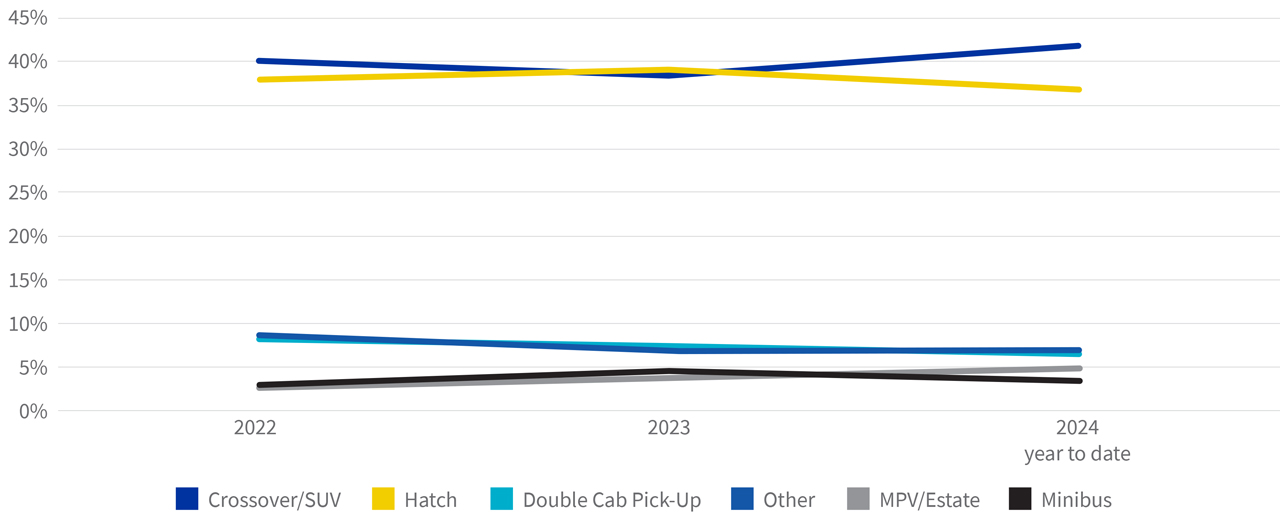

Crossover/SUVs lead body shape choice in new car purchases

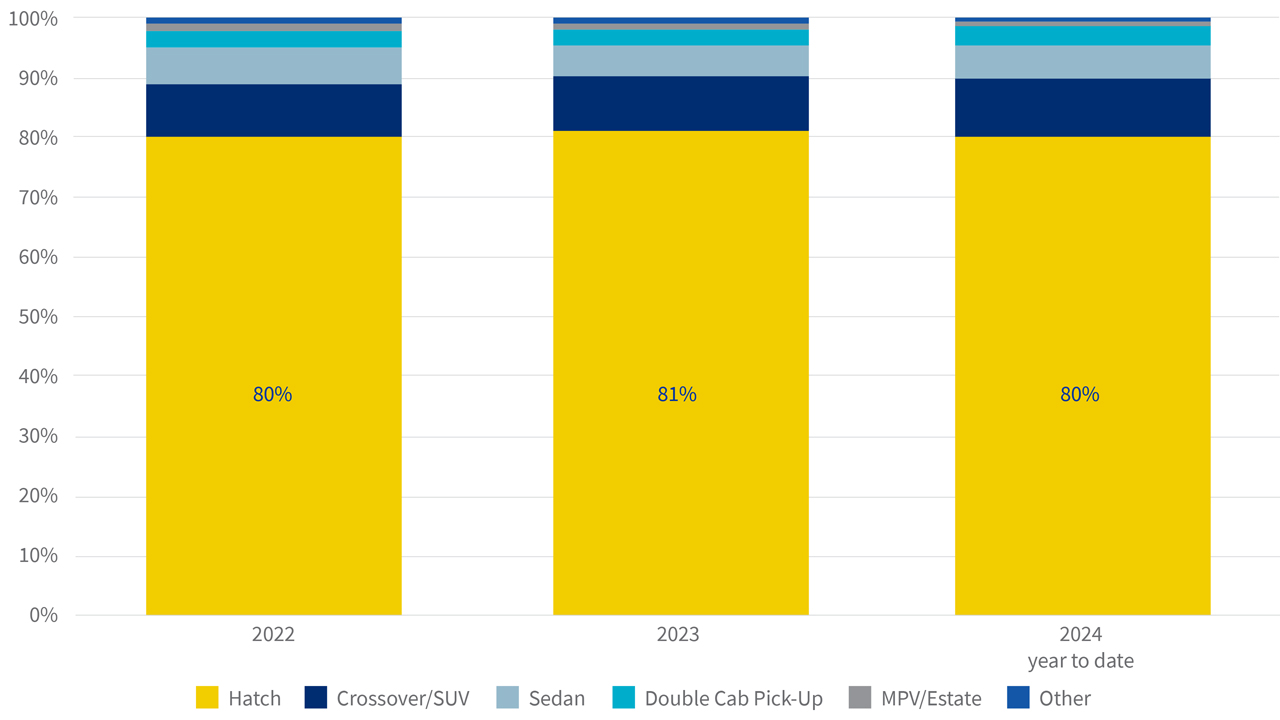

Crossover/SUVs are the first choice among under 35s buying new vehicles, reclaiming top spot from the Hatch after being pushed into second spot in 2022. Together, they make up more than 80% of purchases by buyers under 35.

Double Cab Pick-ups have dropped off in popularity over the last couple of years, while the MPV/Estate has moved up to fourth place in the ranking.

New vehicle body shape preference of under 35s

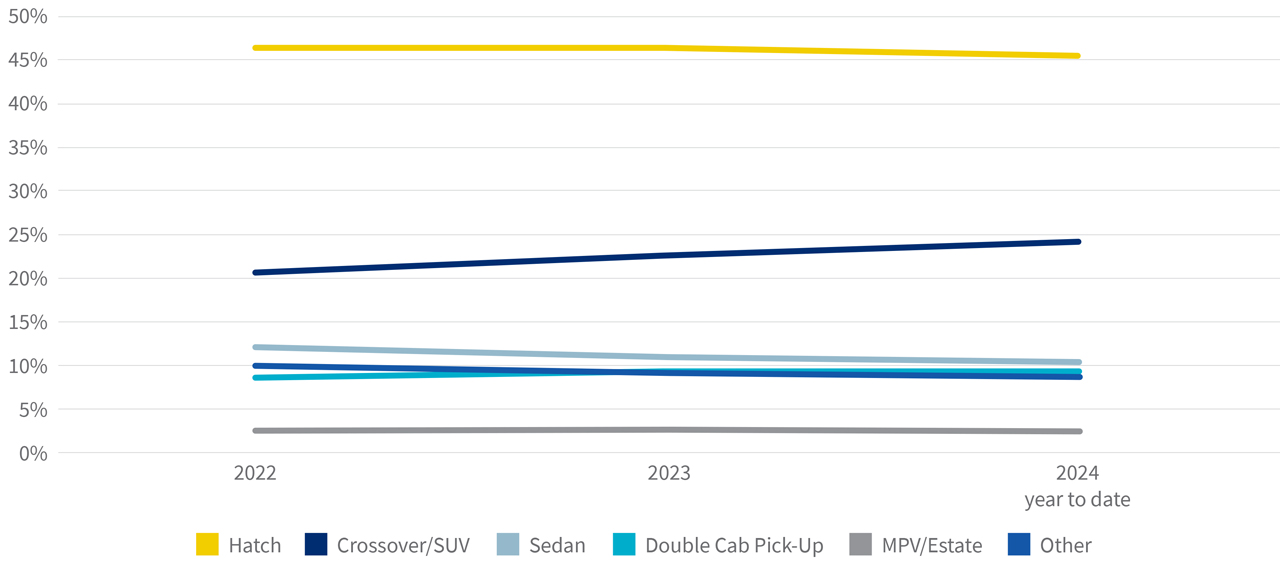

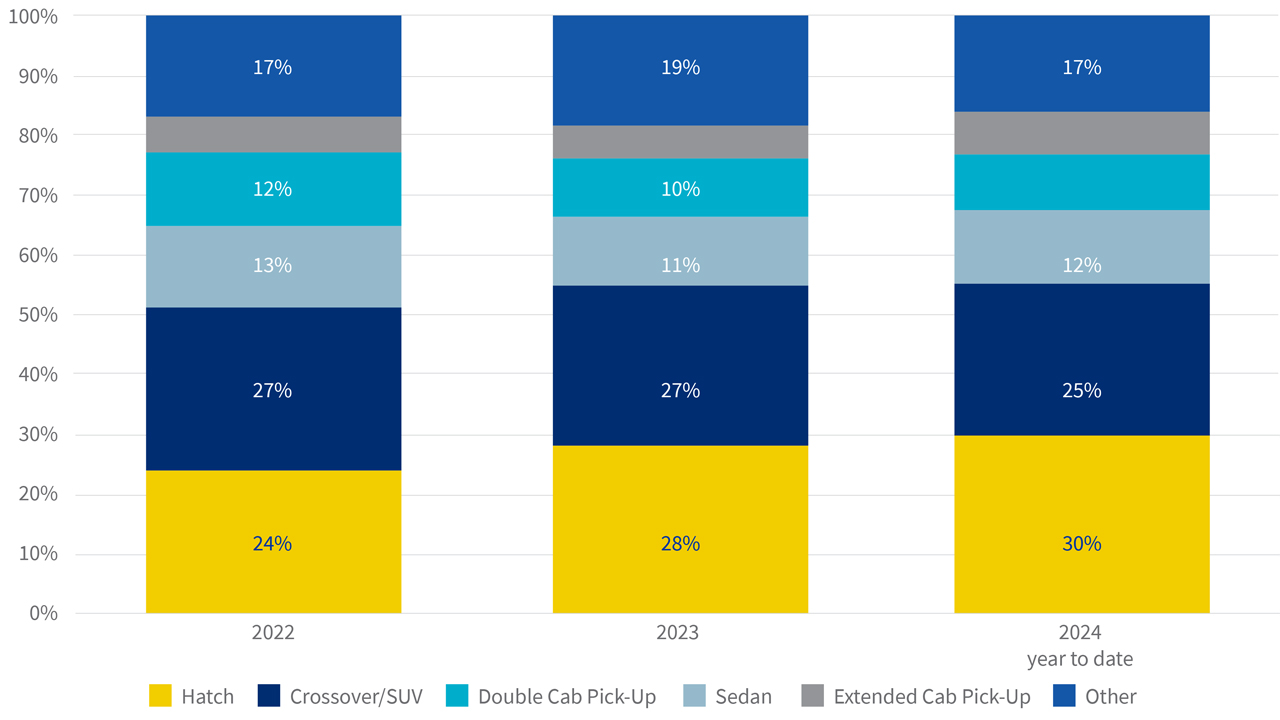

The Hatch remains comfortably the top seller in the used car market, but demand has cooled in 2023 and 2024.

Used vehicle body shape preference of under 35s

The Crossover/SUV is a distant second, but is gaining popularity, mirroring the growth in the new market. Sedans are holding onto third place amongst the body shapes preferred by under 35s, but with a shrinking share of market.

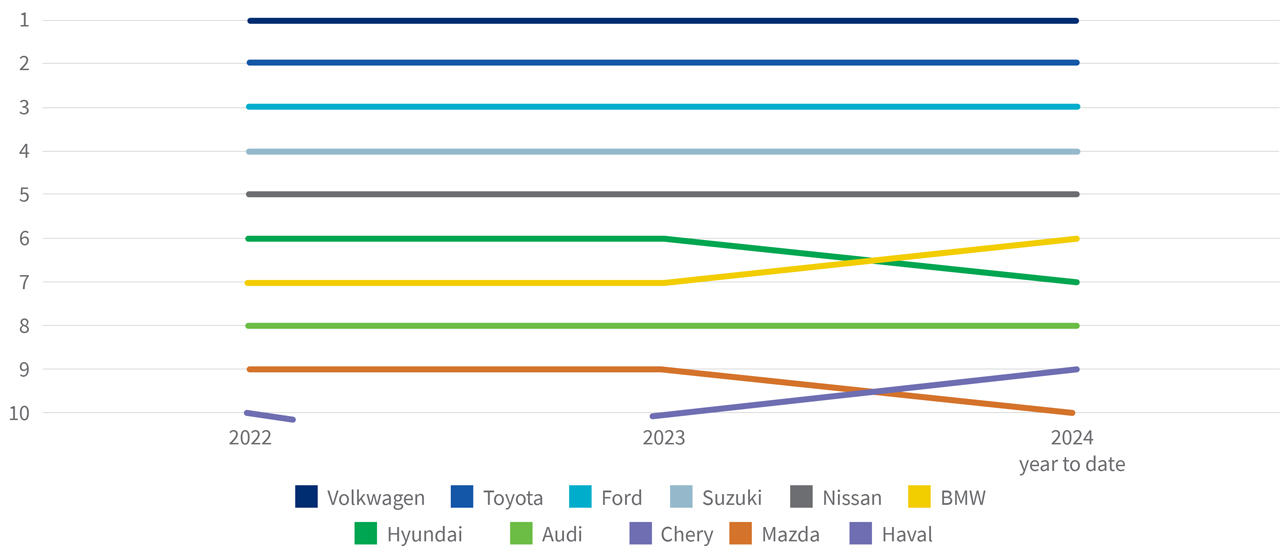

Favourite brands

The top five positions have remained unchanged over the past two years, with Volkswagen leading, followed by Toyota, Ford, Suzuki, and Nissan. The top 5 make up around 65% of all sales (new & used) to under 35s.

Favoured brands of under 35s

Notably, Chery, from China, entered the top 10 in 2023 and moved to 9th in early 2024.

The top 3

Volkswagen body shape breakdown for under 35s

The graph above clearly shows 80% of under 35s like the Volkswagen Hatch space, while the Crossover/SUV is next with just under 10% of sales. Hunger for the Sedan appears to be waning.

Toyota body shape breakdown for under 35s

Buyers of Toyota (graph above) are more evenly spread across body shapes, with the Hatch and Crossover/SUV the dominant two, followed by the Double Cab Pickup and then the Sedan which, as with other brands, continues to lose popularity.

The Double Cab Pick-up was the most popular body shape amongst Ford buyers in 2023 and into 2024, overtaking the Hatch, which was the leading choice of Ford buyers in 2022. The Crossover/SUV is in third spot.